Life Insurance Knowledge Tips

Life insurance pays a tax-free cash payment when you die. It can provide one of the most efficient tax-free cash flow solutions to Canadians who wish to meet their financial obligations even after they’re gone.

![AdobeStock_337194953-[Converted] tightrope string](https://goinsureme.ca/wp-content/uploads/2020/12/AdobeStock_337194953-Converted.png)

Life insurance helps show someone you care about them and wish to make provisions for them in the event you pass away prematurely or for when you die.

We can help you protect what matters most with simple, straightforward insurance solutions that offer peace of mind and no longer worry about what ifs.

![AdobeStock_300239758-[Converted] tomorrow is a promise banner art](https://goinsureme.ca/wp-content/uploads/2020/12/AdobeStock_300239758-Converted.png)

The best time to buy insurance was yesterday. The next best time is today. While most people qualify for something, it can be costly for not planning sooner.

We have expertise in all areas of life, critical illness, disability, and health insurance. It can be a challenge to navigate on your own, and you are not alone. We can help.

![AdobeStock_267575582-[Converted] life insurance art](https://goinsureme.ca/wp-content/uploads/2020/12/AdobeStock_267575582-Converted.png)

When we pass away, our loved ones face two essential money needs—a necessity for cash flow and income. The amount required will vary for short and long-term needs.

Most start by calculating debt and the years needed to replace income against available assets. It shows the shortfall required to keep the family financially stable and secure.

A promise kept to protect their future

Losing a loved one is devastating. If you had passed away yesterday, what is the dollar amount you see on a cheque that takes away the financial worry and provides assurance your loved ones know they were cared for and will be okay financially?

Life insurance is a way to protect the ones you love by providing cash flow and income replacement when you pass away prematurely or help minimize tax in retirement.

What are the TWO main types life insurance?

Life insurance gives you say on how you are remembered, can help replace lost income and cover the cost of day-to-day expenses, pay your children’s education until they are grown, and address succession planning, estate transfer, and retirement planning needs.

Take advantage of the benefits of both types of life insurance. Structure your plan so it has a combination of term insurance for short term needs should you die too soon, and permanent insurance for when you die. Our plans come with a cost of insurance that is contractually guaranteed.

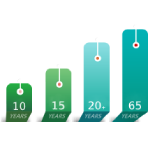

Term

Initially low-cost, increasing dramatically at each term renewal, protection is finite and typically cancelled before its expiry by the policy owner.

Considerations

When selecting a term product, consider the period of when you will be debt free, have retirement fully funded, and no

dependents.

Permanent

Coverage stays in place until death, no matter how long you live. Three common types of permanent insurance we offer are universal life, whole life, and EquiBuild hybrid life.

Considerations

Some plans have cash values, and some do not. Some plan structures are better for estate planning, where other contracts are better for building wealth.

Term

Coverage for a set amount of time.

Term insurance can protect short-term needs, like eliminating debt and replacing earned income to help support people you care about and ensure they will be okay.

Initial payment is for a set period of time, then increases on renewal. The death benefit is paid as long as payments are up to date when the insured dies.

Qualifying for coverage usually requires answering lifestyle and medical history questions and sometimes a blood/or urine test and blood pressure check.

Permanent

Coverage for your entire life.

This type of life insurance provides lifelong coverage. Typically, permanent life insurance combines a death benefit with a savings component or cash value.

Specific types of permanent plans include Universal Life, Term 100, and Whole Life. Payments can paid over a lifetime, or a shorter period determined at time of purchase.

It’s worth considering at least enough to cover funeral expenses, probate, taxes on deferred income, property and capital gains tax, and your other estate needs.

Types of permanent insurance?

Recommendations are based on your goals. Then using the same assumptions, we do a side-by-side analysis and examine the features and characteristics of permanent options, showing which type best meets your objectives.

![AdobeStock_288162441-[Converted] preparing for the road ahead](https://goinsureme.ca/wp-content/uploads/2021/01/AdobeStock_288162441-Converted-e1609905019767.png)

One difference from whole life coverage is the pricing of insurance is based on current interest rates, and provides both a death benefit and an investment component.

Guarantees vary and selected at time of application. The values should be reviewed and compared against the original illustration, and annual statements at least once a year.

![AdobeStock_288162441-[Converted]1 life preserver](https://goinsureme.ca/wp-content/uploads/2021/01/AdobeStock_288162441-Converted1-e1609905005623.png)

A difference from universal life is the cost is based on very long-term interest rate assumptions, and provides both a death benefit and an investment component.

Guarantees vary and selected at time of application. The values should be reviewed and compared against the original illustration, and annual statements at least once a year.

![AdobeStock_288162441-[Converted]2 domino effect](https://goinsureme.ca/wp-content/uploads/2021/01/AdobeStock_288162441-Converted2-e1609904993209.png)

Hybrid plans offer a combination of elements of traditional whole life and universal life insurance, with a few additional features. While only available for new sales from 2015-2023 – they offer lifetime coverage.

Hybrid permanent coverage should not be confused with having the addition of a term rider on a whole life, universal life, or hybrid plan.

Tips

6 tips for buying life insurance

Navigating the insurance landscape does not have to be complex

Buying life insurance for the first time can feel overwhelming. But it does not have to be that way. We can help you make the process a lot easier with these helpful tips.

Work With Professionals

Make Sure It Is Affordable

The best plan is the one you can afford today. Work with your advisor so they can complete a security needs analysis and then downscale for what you can afford because the one you cannot afford is poor planning.

Do Not Wait

Many contracts allow you to requalify when you have stopped smoking, lost weight through healthy lifestyle changes, or have a pre-existing condition improved. If your ‘insurability factor’ worsens, your initial rates are guaranteed contractually.

Protect Your Financial Future – Not The Lender

The Canadian Bank Act prevents retail banks from selling life insurance. Bankers, not licensed agents, sell creditors’ protection and mortgage insurance. The bank wants borrowed funds protected. But those you love will need money too.

Have It In Writing

Do not cancel existing coverage until after your advisor has explained the advantages and disadvantages of replacing it with a new policy. Make sure all ‘Life Insurance Replacement Declaration’ questions are answered.

Use Caution When Purchasing Online

Ask for a copy of their Privacy Statement and Advisor Disclosure. It shows which carriers they offer, what the conflicts of interest are, and how they follow Needs-Based Sales Practices

MIB Reporting

Advanced Planning

CHS CLU

A Licensed Insurance Advisor Is Your Best Navigator

The more you share, the better we can recommend what is right for you. While traditional plans with full underwriting can offer lower rates for many, skipping the medicals and partial-underwriting or non-traditional plans may be better.

What To Blog About

Yup. There is a blog that addresses each of these. Still, there are many nuances, and tailored advice for your situation and needs will serve you best.

Are Life Insurance Policies Taxable?

Life insurance death benefits are usually tax-free. The investment growth in cash value policies is not subject to accrual taxation, which means your money grows faster.

What Should You Do When Your Term Life Renews?

All term policies have an expiry date, and most have a renewal date. While renewal is often mistaken for expiry, they are not the same. If you are still in good health before renewal, reapplying for new coverage is a choice. If you are not as healthy or have become uninsurable since your initial purchase, see if the plan initially obtained has exchange privileges, options to switch to a longer-term, or allow for partial conversion to permanent life insurance. Most offer the option for a full conversion, but this is often too costly if not planned.

Can You Buy Life Insurance With A Medical Condition?

Yes, people with pre-existing medical conditions may qualify for plans at standard rates or mild surcharges. Even a history of cancer and diagnosed depression cannot prevent you from getting life insurance. Shop around and look for someone with a CHS™ designation, the premier credential in the health insurance market, someone like our most senior advisor, Vaneesa Cline.

What Is Permanent Life Insurance For?

Permanent life insurance refers to a set of life insurance policies that provide coverage for your entire lifespan. Whether you die prematurely or at life expectancy, your beneficiaries or estate receive a death benefit.

What Is The Best Life Insurance For Seniors?

Guaranteed issue plans are available to everyone up to age 80 with a two-year deferred benefit. More choices are available when you are in good health at the time of application with issue ages up to eighty-five. The right choice depends on your desire. The cost of insurance is primarily based on age, gender, health, amount, and type; with the lowest cost being yesterday. Most people want at least enough to pay a tax-free benefit for final expenses, including deferred taxes and burial costs.

For Business Owners

CLU

![AdobeStock_329106048-[Converted] puzzle heart art](https://goinsureme.ca/wp-content/uploads/2020/12/AdobeStock_329106048-Converted.png)

Insurance puzzle

Many Canadians find insurance confusing and intimidating. While they understand the core concept and need it, sometimes there is a gap in understanding the benefit. We work with clients to help ensure they know how insurance can address a concern and help them get the coverage that’s right for them.

Our licensed insurance advisors offer tailor-made advice.

Life Insurance Options Available

Solutions for short-term needs may include eliminating debt, replacing lost income on death, or far-reaching goals to preserve and protect wealth, leave for charity, or minimize tax.

![AdobeStock_267969768-[Converted] ci heart attack cancer stroke insurance](https://goinsureme.ca/wp-content/uploads/2021/01/AdobeStock_267969768-Converted.png)

![AdobeStock_299775820-[Converted] critical illness wishlist](https://goinsureme.ca/wp-content/uploads/2021/01/AdobeStock_299775820-Converted.png)

![AdobeStock_357672926-[Converted] critical illness decisions](https://goinsureme.ca/wp-content/uploads/2021/01/AdobeStock_357672926-Converted.png)

When Benefits Pay

What Does Life Insurance Cover

Traditional life insurance pays a tax-free lump death benefit when the insured person dies. Non-traditional coverage may have a lower or deferred death benefit of up to two years on non-accidental death.

Guaranteed Issue

Guaranteed Acceptance Insurance

If you are between the ages of 18 and 64, you can qualify for up to $50,000 of Guaranteed Issue Life Insurance without having to answer any questions about your personal or family medical history.

Who is it for?

Present Risk that Impacts Life or Longevity

Protection for those with significant health conditions already and would not qualify for traditional or simplified issue insurance. Since the only qualifying criteria is the ability to make payments, a deferral period lasting 12 or 24 months will apply.

Take Away Worry

Cashflow

Takes away financial worry and provides cashflow when it is need most when your not here.

Non Medical Simplified Issue

Yes/No Questions

The application is limited to answering yes/no health and lifestyle questions. It can be a good fit for some pre-existing health and lifestyle insurability risks. It is also a good fit if you want to skip the full underwriting required to be eligible for the best plans. It provides a satisfactory solution for coverage up to $500,000.

Who is it for?

Easy Application

Some examples include people with pre-existing conditions, those who participate in riskier avocations, travel outside of Canada for long periods, or do not wish to go through traditional underwriting.

Navigate

Professional Advice

The best fit is based on your unique situation. Book your complimentary, confidential consultation today.

Comprehensive Fully Underwritten

Qualify for preferred rates

Traditional coverage is fully underwritten and typically costs less than non-medical simplified insurance. These plans also offer greater flexibility as your life changes, including if your insurability changes.

Who is it for?

With You Every Step Of The Way

Fully underwritten contracts, known as traditional insurance, are for people in good health with no serious medical or lifestyle concerns who want to qualify for the lowest rates.

Complementary Consultation

and Guided Process

Get the coverage you need. Book your no-obligation discovery meeting today.

Discovery

Needs Analysis

Tailor Made Advice

Secure Financial Future

1

Discovery and Pre-Qualification

Your consultation starts with a brief phone chat or virtual meeting to learn more about you. This includes the type of solution you are looking for, how we may support you, and asking questions. At this stage, we can also pre-qualify to help determine which carrier is best.

Needs Analysis

2

Needs Analysis

A completed needs analysis helps ensure you don’t miss out on an opportunity and allows your advisor to make an appropriate recommendation and the information you require to make an informed decision.

Receive Tailor Made Advice

3

Tailor Made Advice

Openness and willingness to share provides you with the best outcomes. After recommending solutions for you to consider, we fine-tune them based on what’s important to you, your needs, and the budgeted amount. It is okay to start based on your assumptions and then end up where you need.

Secure Financial Future

4

Secure Financial Future

We guide you through the application when you are ready, and provide support afterward through significant life changes, make adjustments as life evolves, and at the time of claim. Back to homepage.

How can we help get you started?

Use the get instant quote below to estimate the cost of insurance.

You can use the money for anything you want. Make new memories, finance medical equipment or therapies not covered under universal health care or health benefits plan, pay for childcare or allow your other half to take time away from work while you adjust to a new reality.

Get instant quote or Meet Us