Focus on recovery not your finances

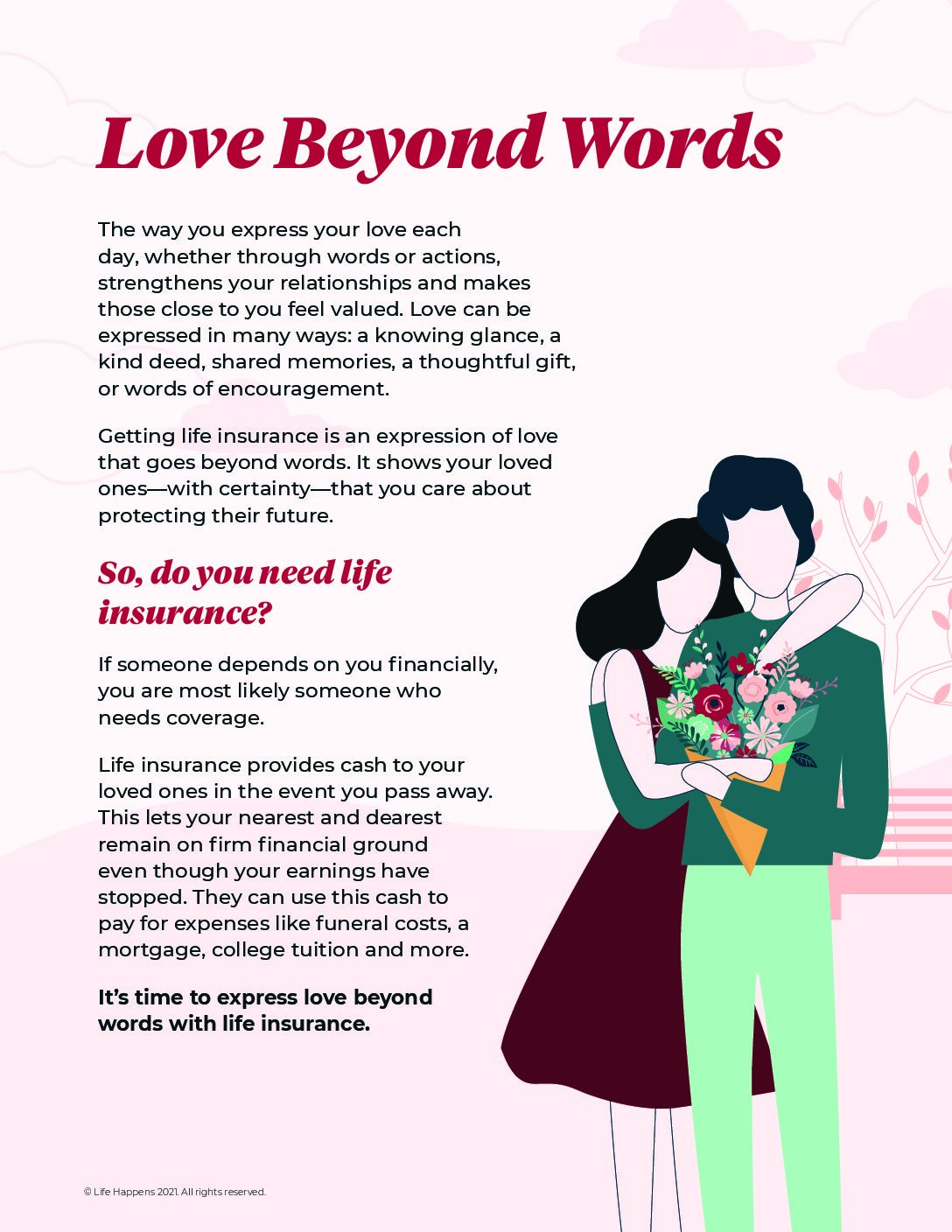

Decades of progress and modern medicine has saved countless lives and improved the health of many Canadians. But survival of a criticall illness can also mean bigger challenges. Many people survive their first heart attack and are usually back at work shortly after. Is this enough time to recover properly?

Understanding the relative risks of various life events can help you create a plan.

Being prepared likely costs a lot less than you think.

The good news is most people are surviving the diagnosis of a critical illness.

Critical Illness Insurance Knowledge Tips

Critical Illness insurance pays a tax-free cash payment when you are diagnosed with a life-threatening illness such as cancer, heart disease requiring surgery, heart attack, or stroke.

![AdobeStock_337194953-[Converted] tightrope string](https://goinsureme.ca/wp-content/uploads/2020/12/AdobeStock_337194953-Converted.png)

We can help you protect what matters most with simple, straightforward insurance solutions that offer peace of mind without you or family worrying about what-ifs.

If you are between 18 and 64, you can qualify for up to $50,000 of Guaranteed Issue Critical Illness without answering any questions about your personal or family medical history.

Most people qualify for something. We can help determine what you can best qualify for..

![AdobeStock_300239758-[Converted] tomorrow is a promise banner art](https://goinsureme.ca/wp-content/uploads/2020/12/AdobeStock_300239758-Converted.png)

Critical illness insurance pays out a lump sum benefit upon diagnosis of one of the covered conditions. The number of conditions varies and will be detailed in your contract.

Comprehensive plans will also cover kidney failure, blindness, organ transplant, paraplegia, quadriplegia, and/or dementia.

On children’s coverage, type 1 diabetes mellitus and cystic fibrosis are covered under some children’s policies up to age 24.

![AdobeStock_267575582-[Converted] life insurance art](https://goinsureme.ca/wp-content/uploads/2020/12/AdobeStock_267575582-Converted.png)

Diagnoses of a life-threatening illness, we are more likely to survive and not die. Having liquidity helps ease the burden and does not impact savings for what was initially intended.

The total living benefit amount is paid directly to you. You alone can decide how and when the money is spent, helping you and your loved ones focus on recovery.

Coverage for six months of lifestyle expenses helps buy time to adjust to a new reality with ease.

A promise kept to protect their future

Navigating your way through a catastrophic illness is stressful. It forces many to make financial decisions they would not make otherwise, like disposing of assets and savings at a bad time.

Critical illness insurance provides one of the most efficient tax-free cash flow solutions to Canadians who don’t want to worry about financial obligations during a life changing time.

Critical Illness Insurance Options Available

The good news is that most people are surviving a critical illness diagnosis. Still, the joint probability and incidence rates for cancer and heart disease amongst a couple is 40%. Understanding the relative risks of various life events can help you create a plan. Being prepared likely costs a lot less than you think.

![AdobeStock_267969768-[Converted] ci heart attack cancer stroke insurance](https://goinsureme.ca/wp-content/uploads/2021/01/AdobeStock_267969768-Converted.png)

![AdobeStock_299775820-[Converted] critical illness wishlist](https://goinsureme.ca/wp-content/uploads/2021/01/AdobeStock_299775820-Converted.png)

![AdobeStock_371234815-[Converted] Questions we can answer](https://goinsureme.ca/wp-content/uploads/2021/01/AdobeStock_371234815-Converted.png)

When Benefits Pay

What Does Critical Illness Insurance Cover

Critical illness insurance pays a tax-free lump sum benefit when diagnosis with a covered condition detailed in your contract. Most plans cover 16-26 conditions and typically include cancer, heart attack and stroke.

Guaranteed Issue

Guaranteed Acceptance Insurance

If you are between the ages of 18 and 64, you can qualify for up to $50,000 of Guaranteed Issue Critical Illness without having to answer any questions about your personal or family medical history. Most plans are issued the same day.

Who is it for?

Present Risk that Impacts Life or Longevity

Protection for those with significant health conditions already and would not qualify for traditional or simplified issue insurance. Since the only qualifying criteria is the ability to make payments, a deferral period lasting 12 or 24 months will apply.

Take Away Worry

Cashflow

Takes away financial worry and provides cashflow when it is need most when diagnosed with a covered condition.

Non Medical Simplified Issue

Yes/No Questions

The application is limited answering yes/no health and lifestyle questions. Payments are based on the first tier applicants answer yes, without having to disclose details.

Who is it for?

Easy Application

Some examples include people with pre-existing conditions, those who participate in riskier avocations, travel outside of Canada for long periods, or do not wish to go through traditional underwriting.

Navigate

Professional Advice

The best fit is based on your unique situation. Book your complimentary, confidential consultation today.

Comprehensive Fully Underwritten

Qualify for preferred rates

The application is limited answering yes/no health and lifestyle questions. Payments are based on the first tier applicants answer yes, without having to disclose details.

Who is it for?

With You Every Step Of The Way

Fully underwritten contracts, known as traditional insurance, are for people in good health with no serious medical or lifestyle concerns who want to qualify for the lowest rates.

Complementary Consultation

and Guided Process

Get the coverage you need. Book your no-obligation discovery meeting today.

Discovery

Needs Analysis

Tailor Made Advice

Secure Financial Future

1

Discovery and Pre-Qualification

Your consultation starts with a brief phone chat or virtual meeting to learn more about you. This includes the type of solution you are looking for, how we may support you, and asking questions. At this stage, we can also pre-qualify to help determine which carrier is best.

Needs Analysis

2

Needs Analysis

A completed needs analysis helps ensure you don’t miss out on an opportunity and allows your advisor to make an appropriate recommendation and the information you require to make an informed decision.

Receive Tailor Made Advice

3

Tailor Made Advice

Openness and willingness to share provides you with the best outcomes. After recommending solutions for you to consider, we fine-tune them based on what’s important to you, your needs, and the budgeted amount. It is okay to start based on your assumptions and then end up where you need.

Secure Financial Future

4

Secure Financial Future

We guide you through the application when you are ready, and provide support afterward through significant life changes, make adjustments as life evolves, and at the time of claim. Back to homepage.

How are you going to solve your asset protection puzzle?

Coverage that affords you an opportunity to focus on what is most important.

You can use the money for anything you want. Make new memories, finance medical equipment or therapies not covered under universal health care or health benefits plan, pay for childcare or allow your other half to take time away from work while you adjust to a new reality.

Lifestyle Protection Solutions